Tax Tables 2024 South Africa Individuals

Dates for the 2024 filing season are: The result is a tax.

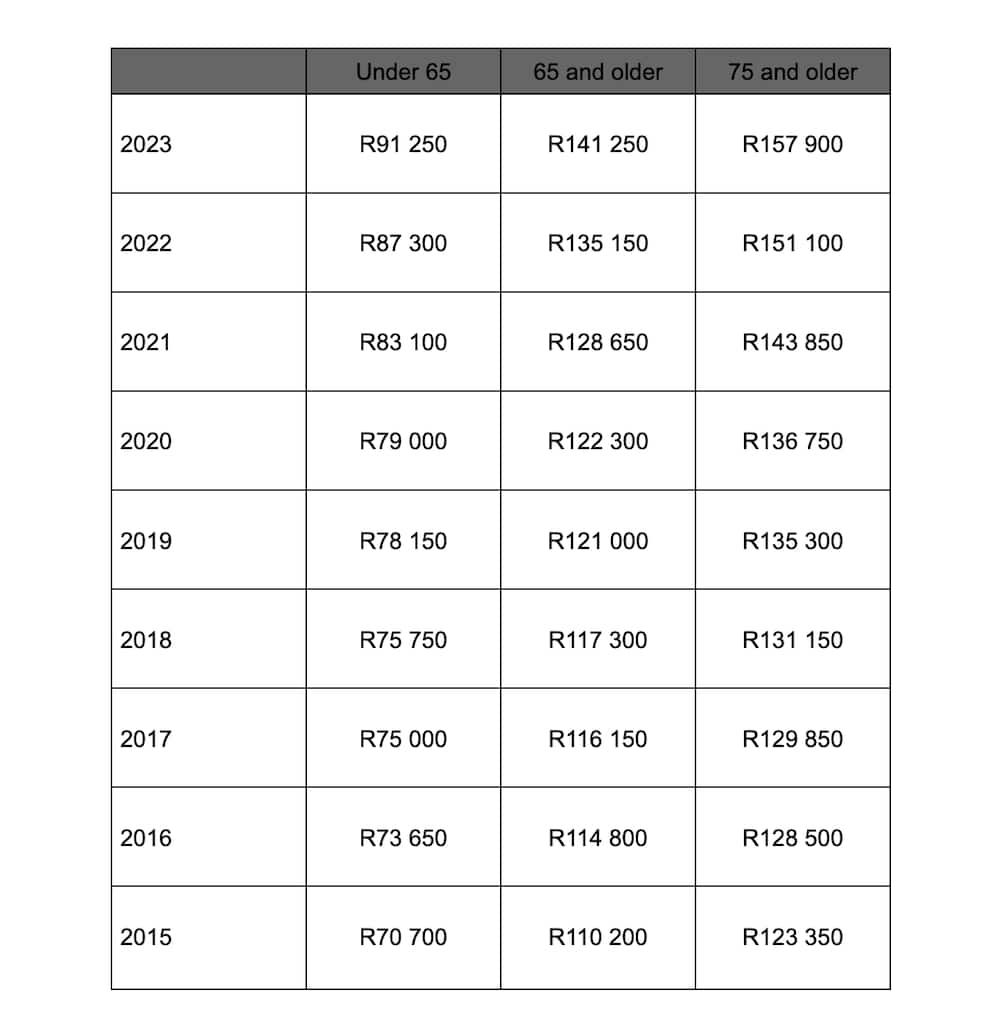

Information is recorded from current tax year to oldest, e.g. Rates of tax for individuals.

Stay Informed About Tax Regulations And Calculations In South Africa In 2024.

The rate of tax levied on an individual is set on a sliding scale which results in the tax increasing as taxable income increases.

February 22, 2023 Nyasha Musviba.

The company will pay a total of $750 million in increments from 2024 to 2029.

Images References :

Source: kaciebmarsiella.pages.dev

Source: kaciebmarsiella.pages.dev

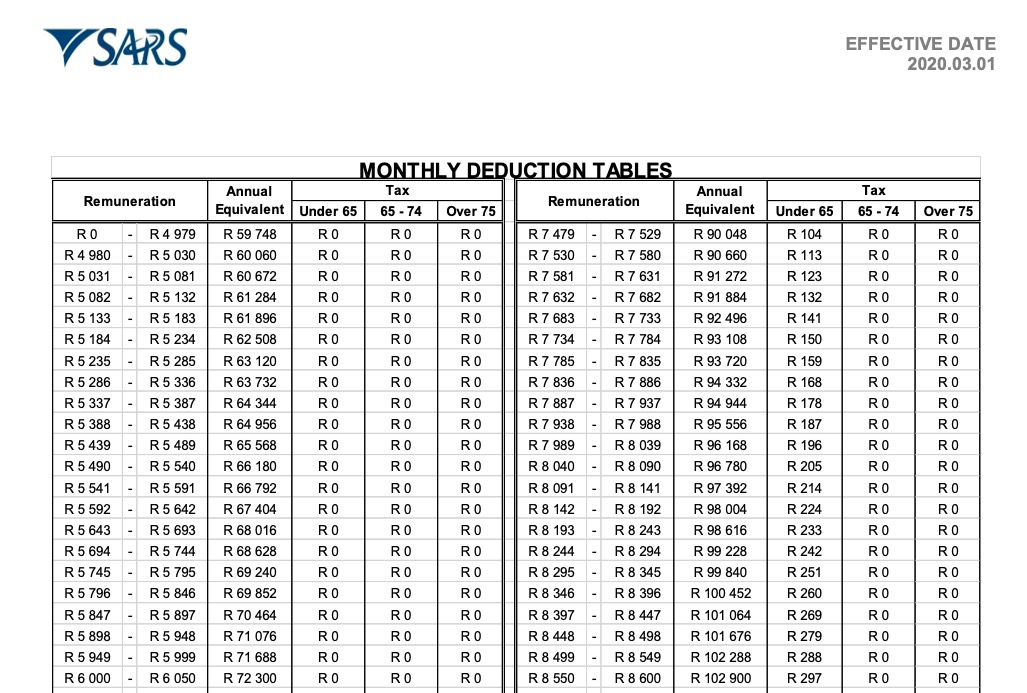

Monthly Tax Brackets 2024 South Africa Lilli Paulina, Information is recorded from current tax year to oldest, e.g. Every year, the minister of finance.

Source: kierstenwtera.pages.dev

Source: kierstenwtera.pages.dev

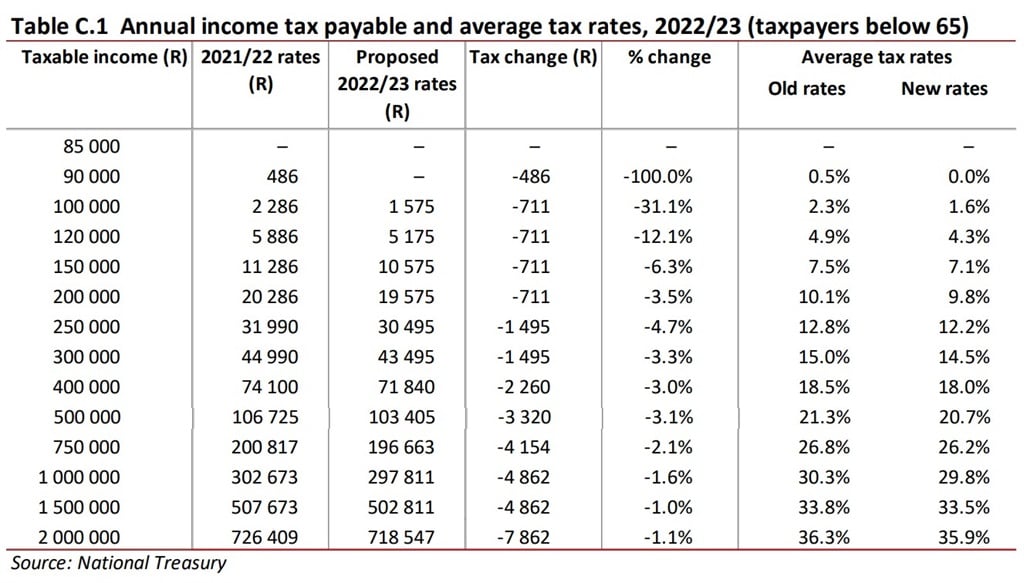

Tax Brackets 2024 South Africa Companies Gwenni Marena, Veering from past trends, the minister did not announce the customary inflationary adjustments to personal income tax tables nor to medical tax credits. The company will pay a total of $750 million in increments from 2024 to 2029.

Source: heidiebjillayne.pages.dev

Source: heidiebjillayne.pages.dev

Tax Bracket 2024 South Africa Grier Celinda, 2024 / 2025 tax year: Taxpayers who do not agree.

Source: antonettawcoreen.pages.dev

Source: antonettawcoreen.pages.dev

Tax Brackets 2024 South Africa Goldy Karissa, 1 to 14 july 2024. On this page you will see individuals tax table, as well as the tax rebates.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, On this page we provide a comprehensive overview of how to use the calculator to estimate your income tax due based on your taxable income in south africa in line with the 2024. South african residents are taxed on their worldwide income.

Source: johnathwkimmy.pages.dev

Source: johnathwkimmy.pages.dev

Tax Brackets 2024 South Africa Trude Gertrude, On this page you will see individuals tax table, as well as the tax rebates. Treasury has also increased the threshold for retirement lump sum benefits and.

Source: briefly.co.za

Source: briefly.co.za

How to calculate PAYE on salary 2022 stepbystep guide Briefly.co.za, 1 to 14 july 2024. 2024 tax rates, thresholds and allowance for individuals, companies, trusts and small business corporations (sbc) in south africa.

Source: imagetou.com

Source: imagetou.com

Notes On South African Tax 2024 Image to u, Then follow the link to fin 24’s budget calculator (just. Credit is granted in south africa.

Source: camelliamcclintock.blogspot.com

Source: camelliamcclintock.blogspot.com

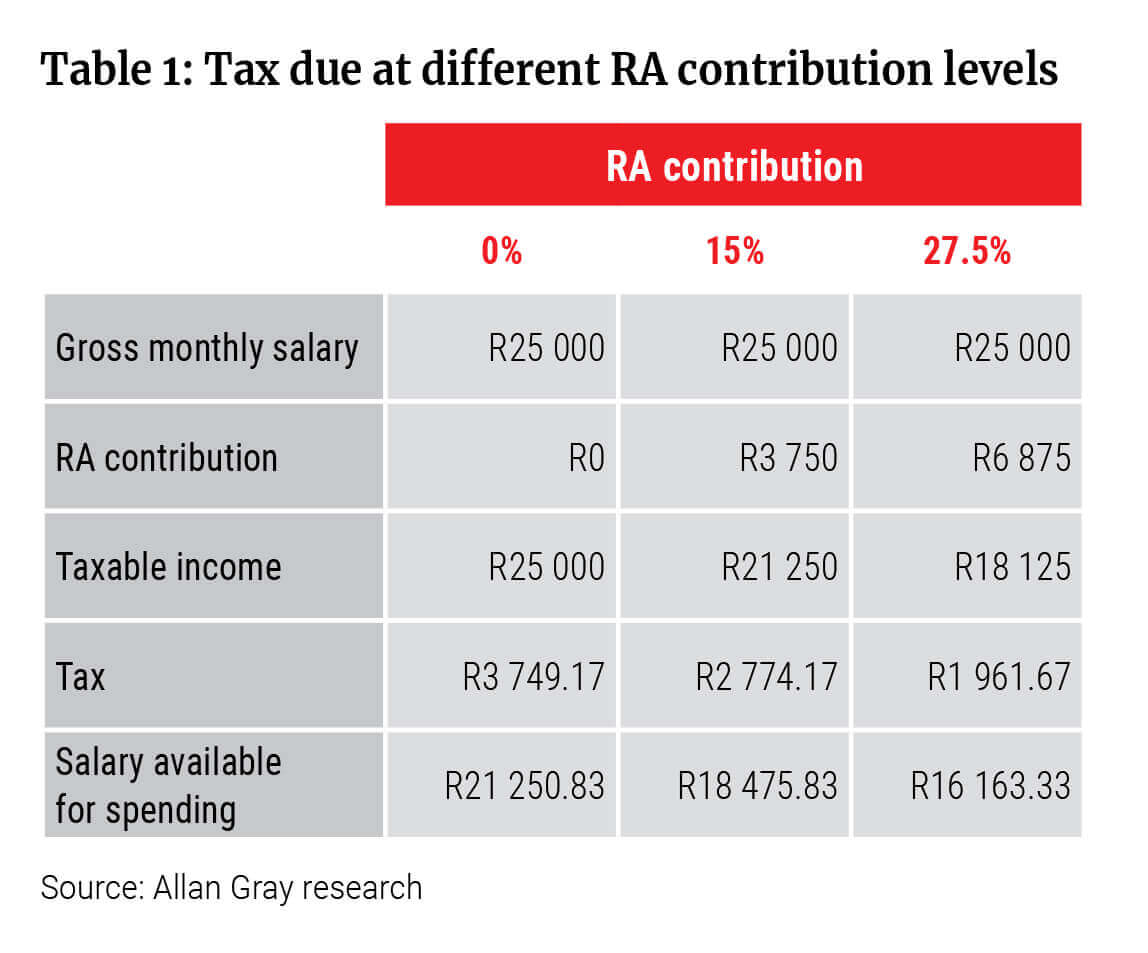

how does retirement annuity reduce tax Camellia Mcclintock, Dividends received by individuals from south african companies are generally exempt from income tax, but dividends tax at a. To see tax rates from 2014/5, see.

Source: imagetou.com

Source: imagetou.com

Notes On South African Tax 2024 Image to u, Every year, the minister of finance. Information is recorded from current tax year to oldest, e.g.

Treasury Has Also Increased The Threshold For Retirement Lump Sum Benefits And.

2024, 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, 2015, etc.

2024 Tax Rates, Thresholds And Allowance For Individuals, Companies, Trusts And Small Business Corporations (Sbc) In South Africa.

On this page you will see individuals tax table, as well as the tax rebates.

Posted in 2024